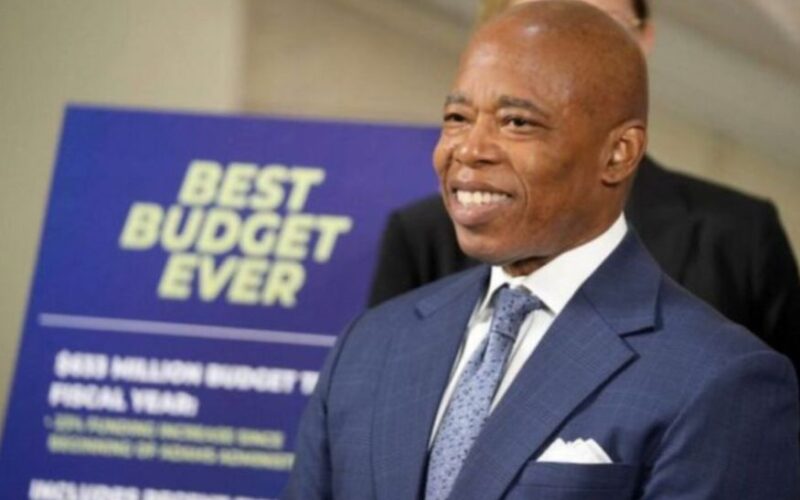

On Thursday, Mayor Eric Adams unveiled a landmark initiative to help New York City residents tackle student loan debt and save for college, potentially injecting $1 billion back into working families’ wallets.

Following a successful pilot with the company Summer, the revamped program grants more people access to resources and counseling that simplify repayment and college planning. Started in May for city workers, the program is now open to all residents—8.5 million people in total.

Lower Payments, Higher Savings

So far, 2,000 public employees benefited, erasing $13.8 million in student debt. Now, an estimated 1.4 million student loan holders and 1.6 million parents or guardians with college-bound kids can use Summer’s no-cost online portal.

The resources assist users with repayment plan comparisons, federal paperwork management, and loan forgiveness opportunities. Those with advanced degrees stand to save as much as $7,000 per year; families may reduce college costs by up to $10,000 per child each year.

“Getting an education shouldn’t lead to a lifetime of debt,” Adams said. “We are lowering costs for families, helping them connect to debt relief, and making our city the best place to find opportunity, raise a family, and live the American Dream. New Yorkers deserve their fair share, and our administration is delivering it to them every day.”

One-Stop Tools for Families and Students

NYC residents can access Summer’s portal to estimate costs, explore savings plans, and connect to federal programs. The new suite of tools will complement ongoing efforts including NYC Kids Rise, an initiative that assists families in preparing for their kids’ educational futures.

“Leading a financially healthy life is a difficult task when you are tackling student loan debt — something I know firsthand,” said Consumer and Worker Protection Commissioner Vilda Vera Mayuga.

Broader Efforts to Lighten Financial Burdens

Adams’ broader affordability plan for the city includes the student debt program. The administration has linked residents to over $30 billion in benefits, broadened tax credits, cleared $2 billion in medical debt, and supported thousands with DCWP’s financial guidance and free tax prep services.

Legislators and advocates have hailed the expansion as a national benchmark for local efforts to resolve the student loan crisis.

Leave a Reply